This is a long post about how to pay for college. It gets wonkier and more detailed as it goes, and it’s full of more information than you can take in in one reading. At the bottom are exhaustive, comprehensive links. But first, an overview.

Skim this. Come back to it. But read it and learn it, because this is what you need to know so you can afford college.

Financial aid can be intimidating and scary and chases a lot of parents off because it’s full of jargon and terms that don’t mean what they sound like they mean.

You hear about kids getting $400,000 worth of scholarships, and then you hear about kids graduating $120k in debt.

I’m going to make the breakdown of this super simple, which means, obviously, this isn’t the full story and you’ll have to do your own research and read more. There are more details (lots more!) further down for those who want to dig in.

Here’s the gist of it: Colleges use financial aid as part of their recruitment strategy. Money has become a means to enroll the particular students that an institution most wants. So your kid has to find the college that wants them and will offer them money to go there.

First: There are two kinds of colleges — Public and private.

Public colleges are the state schools — University of Michigan, University of Texas, University of Washington. There are also lots smaller state schools, like Western Washington University.

They are funded by the state and have little breathing room to help with financial aid. They are already performing at the lowest tuition possible.

When you look at their prices, what you see is what you get.

The other kind of school is a private college: This is everything from Harvard/Yale/MIT to St. Mary’s, Duke, USC, University of Chicago, Rice, all religious schools, and basically every college that isn’t a state school.

They are funded by tuition and donors and sometimes huge endowments. Some of them have a TON of money. Some don’t. They can give you as much financial aid as they want. They can let your kid go for free, or they can make you pay full price. Their “annual cost” is just a starting point, or a negotiation — if they want your kid, they might end up making you a DEAL.

Second: There are two kinds of financial aid: Need-based and merit-based.

Need-based aid is based on your income. It’s done through the government program called FAFSA, which is a guideline meant to help schools determine who needs help paying for college.

The upshot of “need-based aid,” very, very generally, means that anyone who comes from a family that makes under $150k a year should be able to find a way to lower the cost of college to about $20k a year, and maybe less. If you make under about $75k a year, you should be able to find a college that will cost you about $10k a year or less.

(Super general here. Your mileage may vary. Caveat for need-based aid: Not just EVERY college will be affordable. Remember the public schools/private schools thing? Some public schools don’t have the budget to offer financial aid. Some only offer it to people who really need it. Private schools generally have a lot more leeway. If someone says, “With the help of SNAP benefits, groceries will be more affordable,” any sensible person will understand that “groceries” will mean basic, decent quality food and that you will go much further with groceries at a Grocery Outlet buying noodles than you will buying steak at Whole Foods.

So don’t go looking to schools that are broke to supply generous financial aid, even if you have no money for college. Find a college that has money to offer.)

Merit-based aid is based on, well, merit. Doesn’t have to be grades — could be that your kid plays soccer, or has a great singing voice, a perfect SAT, or won awards in science. There is some school out there that wants your kid to attend their school because of what they have to offer, and the school is willing to pay for that. When you find a school that wants your kid, they give you a discount to entice your kid to go there. The school doesn’t care how much money you make — they just want you to choose their school.

For merit aid, your student has to apply to schools that want them to go there. And that might not be the state school down the street. If your student applies to a school that's "lower" than their grades and statistics, the school offers them merit scholarships as an incentive to go there. It's basically a discount that says, "If you go to our school instead of another school, we'll give you half-off tuition." So merit scholarships aren't a "scholarship" in the sense that you can take them from school to school -- it's more like a coupon for Domino's Pizza. You can't use it at Little Caesar's.

What that means is that if your child is trying to get into the "best school" they can get into, or they have their heart set on a particular school that doesn’t offer merit scholarships, they probably won’t get in the way of merit scholarships.

If, however, they want to pay as little as possible for school, then they have to find a school with huge amounts of merit scholarships and have much better grades/scores/achievements than most of the kids applying.

So this is where everything breaks down, along these lines:

Do you want to go to a public school or private school, and is the best strategy to get “need-based aid,” or “merit aid,” or a combination of both?

Need-based aid:

“Need-based aid,” is when you can demonstrate on paper that you need financial aid. Your EFC (the amount you’re expected to pay for a school, and more on that later,) comes in at $5k a year. Or $0. You’re only expected to pay $5k a year, and the school is supposed to come up with the rest. Some schools won’t or can’t, which means you still can’t afford the school — they’ll offer you $10k in financial aid, even though the school costs $50k a year. There’s no way that will work.

But there are schools — all super competitive— that say they “meet full need.”

If you can get into the school, they give you all the financial aid you need to go there.

But if your kid can get in, your kid afford to go to school there.

If you can find and get into a school like that (there are only a few, and they're pretty competitive,) they'll pay for almost everything. My son attended Carelton College -- tuition is $77,000 per year. We pay $11k per year. (For shock value and clarity: More than 60 percent of the students at Carleton, and at many of the “elite” colleges, come from families who can pay the $77,000 cash a year, every year, for all four years. We, um…. we’re not part of that 60 percent.)

If your student doesn’t have the grades and test scores for a "meets full need" college, you'll just be playing a numbers game of checking every college to see what kind of financial aid they offer. There are lots of other strategies for this, including finding a school that give a full scholarship, like University of Alabama (more below.)

But if you make $250k per year and can’t afford to pay tuition, you don’t want “meets full need” schools. They’ll expect you to pay full tuition every year. That’s when you want merit aid.

Merit aid:

There’s another approach, if you have a family that has a reasonably high level of income or assets, and you know won’t get much need-based financial aid. Not all schools offer this — for instance, Carleton College offers no merit aid, just financial aid. Neither does Yale or Harvard. They don’t need to entice kids to go there with coupons.

But if you make more than $100K a year (or even if you don't, and the $100K is general, vague, not set in stone!) then merit aid is the way to go. It’s essentially scholarships that are offered because the school wants your kid to go there. That means that your kid either has a "hook" -- soccer, rowing, theater, science fair -- that will do well at that school, and that the school is one tier or more below the best school your child could get into, and so the school offers $20K per year off tuition, or $40K per year off tuition, if your child attends. This never happens with transfer students. It's pretty much only for freshmen, so this is why the whole “transferring in from a community college” might not be the most affordable strategy.

If you know your EFC (the amount you’re expected to pay for a school) is way too high (the number comes in at $40k per year, but you’re rich on paper only, have a sick kid, medical bills, no savings, or your husband won’t pay a dime for school, and can only pay $5k per year,) then your child needs merit aid.

Regular financial aid won’t help much, so you focus on schools that want your child, and that offer generous merit scholarships.

That generally means looking for schools that are one or two tiers “beneath” the top schools your kid can get into.

If your kid has great test scores and grades, then lower-tier schools want your kid and will offer $20-$40k per year off the tuition to get them there. They’re called “presidential scholarships” or another fancy name, but essentially they’re coupons: You get $25k a year off tuition if you come to our school because your stats make us look good. Or because they need tuba players, or theater kids from Indiana, or whatever it is your kid has to offer.

What This Means to You

What this means to you is: If money is a factor, you need to figure out whether you’re looking for schools with generous financial aid, or whether you need merit aid, or a combination of both.

For merit aid, you should make sure to apply to colleges where you are clearly in the top third to top quarter of the applicant pool. This means not trying for “the best school you can get into,” but instead, “the best school that’s a good fit, where you’d be at the top of the class.”

If a great college is going way out of its way with money to enroll a particular student—offering more grants and scholarship aid than it does to other students—there must be a good reason. So figure out what reason a college would have for offering you money. Then apply to that college.

You can think about it a few ways: “Highlight your niche,” “play to your strengths,” or “packaging yourself,” but it’s the key to getting good merit aid. Colleges don’t want an even number of equally well-rounded students. They want a well-rounded community full of pointy students. How does your pointyness fit into a college’s community?

Tip: If you don’t know if you’re above, below or in the middle of a college’s applicant pool, a good place to start is the college’s class profile. Google the school you’re interested in and “class profile.”

The details on both need-based and merit-based aid

Need-based financial aid and scholarships:

FAFSA (need-based financial aid.)

This is about how much your family earns and how much you can contribute to college.

This is what most people call “financial aid,” where you have to input everything from your tax returns to your current amount in savings.

This is offered both by the US government and by the schools themselves.

It’s complicated and complex, but generally, if you make less than $150K a year, you’re eligible for some financial aid or loans, if you make less than around $75K, you’re eligible for more, and if you make less than $40K a year, you’re eligible for the maximum amount.

The government is offering to help pay for college, and the government and the schools help families who can’t afford tuition.

The government sets up a formula that tells you how much money you can afford for school. (It’s a number called your EFC, or “estimated financial contribution”— it says how much, in theory, you should have to pay for school.) So, if your number is $9,000, then the government feels that you can afford $9,000 a year for school and that the schools should help you pay for anything beyond that.

If it’s $0, then the government thinks you can’t afford anything for school. They believe the schools should offer you grants or loans to help pay for everything. They will even offer a grant of up to about $3,000 to help cover groceries (called a Pell Grant) and will offer you loans to help.

Using the coupon/SNAP card analogy again: Financial aid is the equivalent of using SNAP benefits. It’s given to you by the government based on their calculations of your income and need. You can only use it at places that accept it, and it’s not going to be as valuable in some stores as in others.

If you have a SNAP card for $200, you can buy $200 worth of steak at Whole Foods, or you can buy $200 worth of ramen at Grocery Outlet. You decide how far you can stretch that $200. And that doesn’t really do much if you need $800 in groceries.

And this analogy, not all stores (or colleges) can afford to (or are willing to) offer $400 in SNAP cards. So, even if you’re “eligible” to have all of your groceries (or tuition) paid for, you still have to find the right store.

If you go to a school that doesn’t take SNAP, or only covers $200 of SNAP, or that takes all $400 but costs $600, you’re still not covered.

So, this is where the merit aid comes in.

If you find a fantastic school that offers you a “discount” on tuition (a lot of merit aid,) and you’re eligible for a lot of financial aid (SNAP cards,) then you can end up paying very little for school.

Not everybody qualifies for this sort of aid, because they’re based on financial need, and it has nothing to do with how much the items cost or what you’re buying.

Now, back to merit aid:

Let’s use the analogy of grocery stores.

Financial aid is SNAP credits for people who need help paying for college.

But merit aid is coupons to entice you to shop at a certain place, and they’ll give you a discount there, whether you have SNAP credits or not.

Lots of schools don’t offer merit aid:

They don’t have to.

They are the “Whole Foods” of colleges. They are expensive, people are willing to pay for it, and they attract a certain clientele. No discounts, no coupons — if you want to shop there, pay full price.

Schools that offer a decent discount with merit aid and will bring the cost down to state school prices:

These schools are Safeway/Kroger/Whatever:

Everyone goes to these schools. Prices are fine. Selection is fine. If you are really smart about using coupons, you can get a great discount, but you have to be clever about how you use them. If you use coupons and you can get your bill down by about half. Your bill will be about the same as if you shop at the outlet store.

State schools:

The Walmart/Winco of colleges:

They are already cheap. No coupons. No discounts.

If you’re shopping here, you get the same groceries as the other stores, no frills.

You know not to bring coupons, because prices are already rock-bottom.

Schools that offer a deep discount because they want to attract high-achieving students:

This is the “JoAnn’s Fabric” of colleges — if they have what you want, and you get a coupon for the items you want, you can walk away with $1,000 worth of stuff for 90 percent off.

But half the time you have no idea how the coupon works, you can’t figure out what’s going on and you don’t get the discount your friend says they got, and the thing you wanted is out of stock, and the cashier doesn’t know how to ring it up.

But if it works?

You get a fantastic deal and everyone is happy.

Examples:

Fancy private school with merit aid, middle-of-the-road student

Southwestern University:

Cost: $64K a year

Merit Scholarship: $35K a year (offered to kids who are in the top percentages of applicants)

Cost remaining: $30K a year

Financial aid and/or need-based scholarships can help pay for the remaining $30K a year. Or not. You might just have to pay $30k.

Example:

State school

Western Washington University ( in-state tuition)

Cost: $25K per year ($9K per year, and housing is $15k)

Merit scholarships:

There are one or two merit scholarships, and they’re for $2,000, and only for two years.

Cost remaining:

$25K per year, or way less if you get creative with housing.

If you’re eligible for financial aid, you might get away with under $10K per year. If you’re not, then you pay full price, and housing is where you can save money. Maybe.

Example of a school that really, really wants high-performing kids to go there:

Carthage College, Kenosha, Wisconsin:

Cost: $56,000 per year

With Presidential Scholarship (32 full or half-tuition scholarships available):

Just the cost of housing ($12k), and that can be helped with financial aid.

https://www.carthage.edu/admissions/undergraduate-students/undergraduate-scholarships/presidential-scholarship-program/

https://www.finaid.wwu.edu/scholarships/pages/wwu_scholarships/list_non_departmental.php?type_ID=1&sub_type_ID=3

Example: Elite Full Ride Scholarship

University of Virginia Jefferson Scholars Program and the Walentas Scholars Program

Everything is paid for, plus extras. Tuition, room, board, travel. All four years. You have to live in a certain area and only 36 kids are chosen and so forth.

https://www.jeffersonscholars.org/scholarships

Example: Full scholarship from a school that wants high-achieving kids:

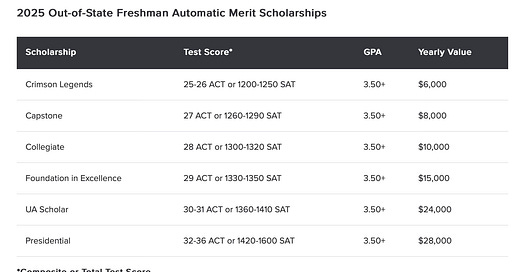

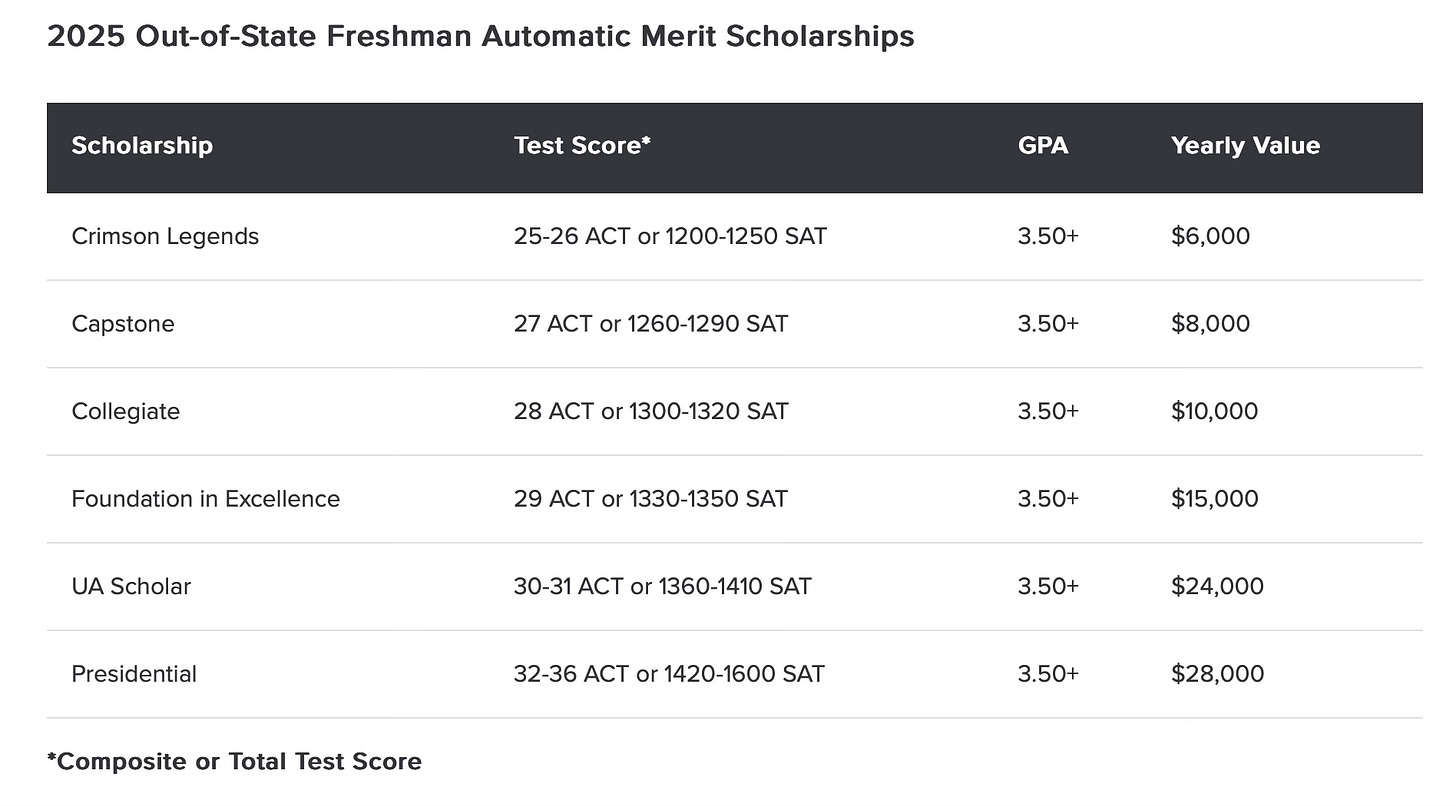

The University of Alabama wants you. Got a high SAT score and a great GPA? Willing to move to Alabama? This is how much they’ll pay to have you go there.

https://afford.ua.edu/scholarships/out-of-state-freshman/

Want to know how much you’ll pay at just about any school? There’s a tool for that.

Use the “net price calculator,” and you’ll get a feel for whether you can afford the

school and how generous they are with aid and merit.

The best place to start is to google any school your kid might be interested in, along with the words “net price calculator.” You’ll get something like this.

https://admissions.wwu.edu/cost/net-price-calculator

That should give you an idea of how much you’ll be expected to pay for each school and what your strategy should be.

Need a full-ride scholarship? Here’s a list of schools that offer them:

https://blog.prepscholar.com/colleges-with-full-ride-scholarships

On to the VERY Wonky Stuff about Financial Aid and your EFC, or “Estimated Financial Contribution”

This is stuff I found a while ago, written by guy named George who’s way more detail-oriented than I am. It’s for people who really, really want to nerd out on this. I don’t expect most people will want to go on this deep a dive, but if it lets your kid attend a college that’s $80,000 a year for $7k a year, it’s probably worth your time, you know? Don’t thank me for this. Thank George.

The best place to start is this roughly 1-hour webinar video: https://bit.ly/EFC-video (note: some parts of this are now out of date)

The slides from that webinar: http://bit.ly/EFC-slides

A conceptual explanation of the EFC formula: http://bit.ly/EFC-concept

A simplified overview of the EFC formula: http://bit.ly/EFC-simplified

What EFC actually means in practice: https://bit.ly/EFC-in-practice

A glossary of terms related to college aid—including an acronym list—can be found here: https://bit.ly/aid-glossary

Once you understand what EFC means and you are ready to dive into the details of the formula, look at these:

2023-24 FAFSA EFC spreadsheet: bit.ly/FAFSA-spreadsheet-2022

How to use the spreadsheet: https://bit.ly/UsingTheSpreadsheet

Prose walkthrough of the spreadsheet: https://bit.ly/EFC-explanation (Note: this hasn’t been updated for 2023-24, and parts are out of date.)

Additional topics

FAFSA EFC vs. Institutional EFCs: https://bit.ly/institutionalEFC

Tracking down FAFSA Errors: https://bit.ly/FAFSA-errors

FAFSA vs. Taxable Income Venn Diagram: https://bit.ly/FAFSA-Venn

Should I use the DRT? https://bit.ly/IRS-DRT

Earned Income on FAFSA: https://bit.ly/FAFSA-earned

Pell Grants, the AOTC, and 529s: https://bit.ly/UCA-federal

The Basics of Asset Reporting: https://bit.ly/FAFSA-assets

To share this list of resources, link to: http://bit.ly/EFC-resources

“Official” Resources from the guy who put together the wonky stuff above

PDF Version of the 2023-24 FAFSA (good for consulting directions, even if you’re completing online)

EFC Formula Guide for 2023-24 (not for the faint of heart!)

Annotated College Financing Plan (this is a model financial aid letter)

The law with the forthcoming EFC changes (really not for the faint of heart!)

Other Recommended “Unofficial” Resources

https://understandingfafsa.org/

A website and PDF Guide to FAFSA, supported by the United Way of New York City. The PDF version is called FAF$A: A How-To Guide for High School Students (And the Adults Who Help Them). Translations into 9 foreign languages are also available, courtesy of the NYC Department of Education. An accessible overview of FAFSA, although it contains little information about how EFC is calculated.

Sara Goldrick-Rab, Paying the Price: College Costs, Financial Aid, and the Betrayal of the American Dream. A 2016 critique of the financial aid “system” as it exists. More of a policy focus than a “consumer focus”.

Rob Lieber, The Price You Pay for College. A valuable 2021 book on how college pricing works, written primarily for a parent audience.

Paul Tough, “What College Admissions Offices Really Want” (NYT subscription required). A great 2019 article on how need-aware admissions work.

Jeff Selingo, Who Gets In and Why: A Year Inside College Admissions In addition to what you might expect from its title, this book also contains a lot of information about how college pricing works in practice and develops his idea of different colleges being “buyer” and “sellers”. (Selingo also offers both free and paid resources for finding more affordable schools.)

https://www.savingforcollege.com/

NPR, “How the most affordable student loan program failed low-income borrowers”. A big caveat about income-driven repayment plans.

Guide to the codes used on Form W-12, Box 12. Helpful on various FAFSA questions, including 89a.

How various colleges use home equity in their institutional EFC calculations. This is the most thorough list of its kind that I have seen, and the only one that is dated—as of 12/29/23, it was dated 11/27/23. The creator is a CPA with a practice focused on paying for college, and her website has a number of links that look worthwhile. I don’t have a practice of endorsing businesses here, and I don’t have any experience with this individual, but based just on her website, if I were looking for a professional to provide guidance on navigating the college aid system, I would start by talking to her firm.